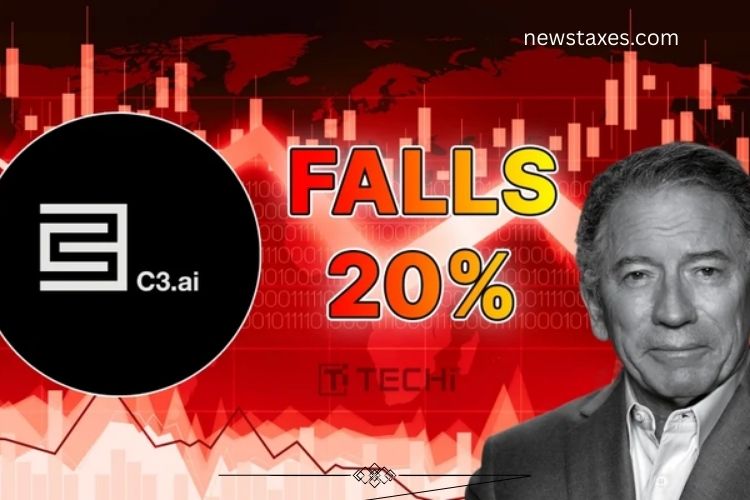

C3 AI, a prominent player in the rapidly evolving artificial intelligence (AI) sector, recently experienced a dramatic 20% drop in its share price following the release of preliminary first-quarter results for fiscal 2026. The disappointing numbers and CEO Thomas Siebel’s candid remarks about their “completely unacceptable” nature have sent shockwaves through investors and the AI industry alike. This downturn underscores the challenges facing the company, including a major organizational restructuring, leadership transitions, and mounting operational costs.

Read More: https://newstaxes.com/exciting-clues-and-the-must-know-answer/

Disappointing Preliminary Results Shake Investor Confidence

C3 AI reported preliminary revenue projections ranging from $70.2 million to $70.4 million, representing a sharp decline of more than 20% compared to $87.2 million in the same quarter last year. Such a steep drop in revenue immediately raised concerns among investors, highlighting both market pressures and internal challenges.

CEO Thomas Siebel did not mince words when addressing the results, calling them “completely unacceptable.” He attributed part of the performance decline to the significant disruption caused by a large-scale reorganization of C3 AI’s global sales and services teams. The company’s attempt to restructure its operations to better compete in a fast-moving AI market, while necessary, has introduced short-term instability that is clearly affecting revenue.

Siebel also noted that his personal health issues had limited his ability to be as active in sales engagements as in previous quarters. This added leadership gap compounded the company’s challenges and likely contributed to the disappointing financial performance.

Rising Operating Losses Compound Concerns

Alongside declining revenue, C3 AI reported a sharp increase in operating losses. The company expects losses between $124.7 million and $124.9 million, a significant jump from $72.59 million in the prior year.

This widening loss demonstrates that the revenue shortfall is not the only concern. Rising operational costs, combined with slower sales, have intensified the financial strain on the business. Investors are acutely aware that this combination of declining revenue and growing losses undermines confidence and raises questions about the company’s ability to navigate current market pressures.

The financial outlook signals a challenging environment for C3 AI, emphasizing the need for efficient cost management, strategic sales execution, and strong leadership to stabilize performance in the coming quarters.

Leadership Challenges and Health Concerns

Thomas Siebel’s health issues have been a notable factor in recent developments at C3 AI. In July, Siebel revealed that he suffers from a serious autoimmune disease that caused severe vision problems, limiting his day-to-day involvement in company operations. While his overall health has improved, he continues to experience vision difficulties, which have affected his ability to lead the company as actively as before.

The company has already initiated the search for a new chief executive. Siebel has confirmed his commitment to ensuring a smooth transition by identifying a capable successor. Leadership changes at this juncture are critical, as the company navigates a competitive AI landscape while attempting to restore investor confidence and drive revenue growth.

The Impact of Organizational Restructuring

C3 AI’s recent efforts to restructure its sales and services organizations have had a mixed impact. While the long-term goal is to enhance efficiency and competitiveness, the short-term effects have been disruptive. Sales momentum has slowed as teams adapt to new processes, reporting structures, and strategic priorities.

For investors, this period of adjustment is crucial but uncertain. A restructured sales force may eventually deliver stronger results, but the immediate disruption has contributed to the sharp decline in revenue and growing operational losses. Analysts and shareholders are closely watching the company to determine whether the restructuring will lead to a sustainable rebound or prolong financial instability.

Market Pressure in the AI Industry

The AI sector is experiencing intense competition and rapid innovation, creating additional pressure on companies like C3 AI. Competitors are investing heavily in technology, expanding product offerings, and aggressively pursuing market share. In this environment, even minor missteps in execution or leadership can have outsized consequences on revenue and investor sentiment.

C3 AI’s challenges are compounded by the fact that the market expects consistent growth and innovation from established AI players. The company’s current slowdown, therefore, is magnified by market expectations and the visibility of its public financial performance. This underscores the urgency of regaining momentum and demonstrating operational resilience.

Upcoming Earnings Call: A Potential Turning Point

All eyes will be on C3 AI’s next earnings call, scheduled for September 3. The company has an opportunity to stabilize investor sentiment by providing a clear picture of its sales recovery and detailing the progress of leadership transitions. Positive guidance and tangible evidence of operational improvements could help restore confidence and support the stock price.

However, uncertainties remain. Investors will be looking for concrete indicators that the company can overcome its short-term challenges, manage costs effectively, and deliver sustainable growth in a highly competitive AI market. The upcoming earnings call represents a critical test of C3 AI’s ability to reassure shareholders and chart a path forward.

Investor Sentiment and Future Outlook

Investor sentiment is currently cautious but attentive. The combination of declining revenue, rising losses, and leadership changes has shaken confidence, but the company still holds significant potential in the AI market.

Key factors that will influence future performance include:

- Effective Leadership Transition: Ensuring a capable successor to Siebel can maintain strategic continuity and inspire confidence.

- Sales Momentum Recovery: Quickly stabilizing the sales force and delivering measurable revenue growth.

- Cost Management: Controlling operational expenses to prevent losses from escalating further.

- Market Competitiveness: Remaining agile in an industry defined by rapid technological advancement and intense competition.

C3 AI’s ability to address these factors will determine whether it can rebound in the coming quarters or continue to face pressure from investors and competitors.

Frequently Asked Questions:

Why did C3 AI shares drop 20% recently?

C3 AI shares fell over 20% due to disappointing preliminary Q1 2026 results, which showed a significant decline in revenue and a sharp rise in operating losses. CEO Thomas Siebel also described the results as “completely unacceptable,” intensifying investor concerns.

What were C3 AI’s preliminary revenue numbers?

The company forecasted revenue between $70.2 million and $70.4 million, a decline of more than 20% compared to $87.2 million in the same quarter last year.

How much did C3 AI’s operating losses increase?

C3 AI expects operating losses of $124.7–$124.9 million, up from $72.59 million a year ago. Rising costs combined with lower revenue contributed to this widening loss.

What caused the decline in revenue and increased losses?

The revenue decline was partly due to disruptions from a major reorganization of global sales and services teams. Additionally, CEO Siebel’s health issues limited his involvement in sales activities, which further impacted performance.

How have CEO Siebel’s health issues affected the company?

Siebel suffers from an autoimmune disease that caused severe vision problems. While his overall health has improved, limited engagement in daily operations affected leadership and strategic execution, contributing to weaker results.

Is C3 AI looking for a new CEO?

Yes, the board and Siebel are actively seeking a successor. Siebel remains engaged to ensure a smooth transition and identify a capable leader to take over the company.

How has the sales team restructuring impacted C3 AI?

The restructuring aims to improve long-term efficiency and competitiveness. However, it caused short-term disruption, slowing sales momentum and contributing to declining revenue.

Conclusion

C3 AI’s 20% stock plunge following the release of its preliminary Q1 2026 results highlights the company’s current challenges, including declining revenue, rising operating losses, and leadership uncertainties. CEO Thomas Siebel’s candid assessment of the results as “completely unacceptable” underscores the urgency for swift action. The company faces a pivotal moment: stabilizing its reorganized sales force, managing operational costs, and ensuring a smooth leadership transition are critical to restoring investor confidence. While short-term disruptions have shaken the market, C3 AI’s potential in the competitive AI landscape remains significant.